Expanding the ways in which witholding rates can be applied

Date

05_2025

Page

Sales / Royalties --> Royalties --> Create new rule

Description

Up until now, our witholding period has functioned on the basis that a withholding amount will be taken in every statement generated during the specified term. I.e if your witholding period is 18 months post-publication, and you generated 2 statements in that period, a witholding amount would be taken in both statements and then released after 18 months.

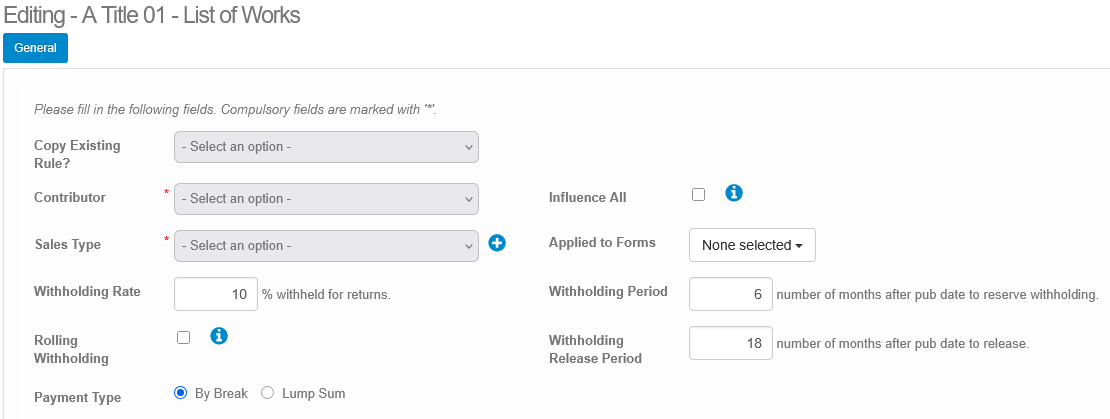

You now have the option to specify both the period in which withholding will be taken and the period that it will then be held for.

- If you do not calculate your withholding on a rolling basis, you will need to fill in Withholding Period and Withholding Release Period.

- Withholding Period denotes the time in which you will take the withholding amount. E.g. if it is 6 months, then any statements that are generated within the first 6 months after publication will have the withholding rate applied.

- Withholding Release denotes the period after which the withholding amount will be released. So, you may want to take withholding from statements in the first 6 months of publication, and return that amount 18 months after publication. In this instance, you would enter 6 in 'Withholding Period' and 18 in 'Withholding Release'. If withholding release is not set, then the value entered in withholding period will be used.

Please note that Withholding Period is mutually exclusive from the Rolling Withholding item. You need one or the other, not both. In the example below, royalties will not be held on a rolling basis. 10% of royalties will be taken from any statements generated in the 6 months after publication, and released 18 months after publication.

Please sign in to leave a comment.

Comments

0 comments